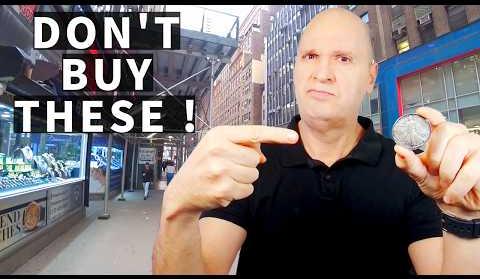

Tag: silver bullion coins

-

Gold Prices Dip Amid Global Uncertainty: Investment Strategies Revealed

Gold prices in India experienced a slight dip, with 24-carat gold falling to Rs 99,800 per 10 grams in the national capital. This decline comes amidst global spot gold trading at $3,365.40 an ounce. Despite the decrease, silver prices held steady at Rs 1,05,200 per kilogram. How to Invest in Gold and Silver: A Complete…

-

Silver Investment Outlook: Seizing Growth Amid Economic Uncertainty

Investing in precious metals like silver can be a strategic move, especially in times of economic uncertainty. Silver, often referred to as the ‘devil’s metal’, has seen a significant rise in prices, making it an attractive investment option for many. While historically silver has been closely tied to gold, its industrial applications set it apart…

-

Silver’s Surging Value Sparks Investor Interest in Precious Metals

The value of silver has been on a significant upswing, prompting investors to consider its potential as a lucrative investment option. While gold has traditionally been a preferred choice for investors seeking stability and growth, the recent surge in silver prices has raised questions about whether it could outperform gold in the current market climate.…

-

Silver Prices Surge Amid Economic Uncertainty and Supply Deficit

Investors have long speculated about the trajectory of silver prices, and the current value exceeding US$30 has sparked further curiosity about its potential to rise even higher. The silver market has a history of volatility, with recent price fluctuations reflecting geopolitical tensions, economic uncertainties, and environmental challenges. Silver’s status as a safe-haven asset adds to…

-

Top Dividend-Paying Silver Stocks for Stable Investment Returns

Silver, a commodity known for its price volatility, is often considered a safe-haven investment and a hedge against inflation. While investing in silver bullion is a common approach, silver-mining companies provide an alternative route for exposure to the metal. These companies, equipped with strong balance sheets and experienced management teams, can benefit from high silver…

-

Silver Investment: Diversify Portfolio with Affordable Precious Metal

Investing in precious metals has long been a popular choice for investors looking to diversify their portfolios. While gold has traditionally been the go-to option, silver is gaining traction as a compelling alternative. With silver priced at a fraction of gold’s value, it presents a more accessible entry point for investors seeking exposure to precious…

-

Exploring ASX-listed Precious Metals ETFs for Diversified Portfolios

Investors seeking to diversify their portfolios have long turned to precious metals like gold. However, silver, platinum, and palladium offer similar benefits with varying price points and industrial applications. These metals have shown low correlations with traditional markets, reducing risk and providing a hedge against volatility. The demand for silver, platinum, and palladium is on…

-

Exploring Silver Investment: Diversify Portfolio Amid Market Volatility

Investing in silver can be a strategic move to diversify your portfolio, especially given the recent bullish trend in the precious metal market. With silver prices inching towards $30, now might be an opportune time to explore silver investment options. Silver, often overshadowed by its more illustrious counterpart gold, offers a unique investment avenue that…

-

Silver Bullion Coins: Affordable Investment Option Amid Economic Uncertainties

Precious metals like silver have gained popularity as safe-haven assets amid economic uncertainties and inflation concerns. While gold remains a top choice for many investors, silver offers a more affordable alternative. The Definitive Guide to Collecting, Investing & Stacking Silver Bullion: 2020 Edition | $18.29 Silver bullion coins, issued by sovereign mints, are considered legal…

-

Silver Investment Outlook 2025: Diversification Amidst Market Volatility

Silver emerges as a promising investment avenue in 2025, offering a blend of historical significance and contemporary market dynamics that make it an attractive choice for investors looking to diversify their portfolios within the precious metals sector. The grey metal, often dubbed as “the gray metal,” exhibits a strong correlation with gold price movements, reflecting…